CASE STUDY

ENHANCING THE OVERALL MEMBER EXPERIENCE THROUGH DIGITAL ISSUANCE AT SELCO COMMUNITY CREDIT UNION

Introduction

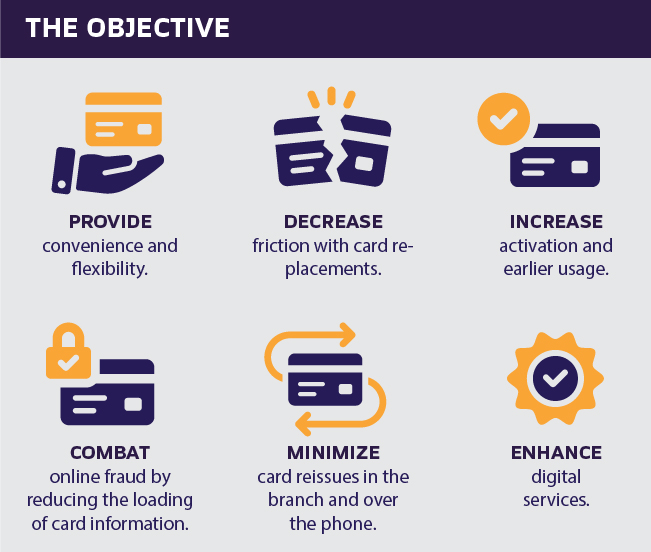

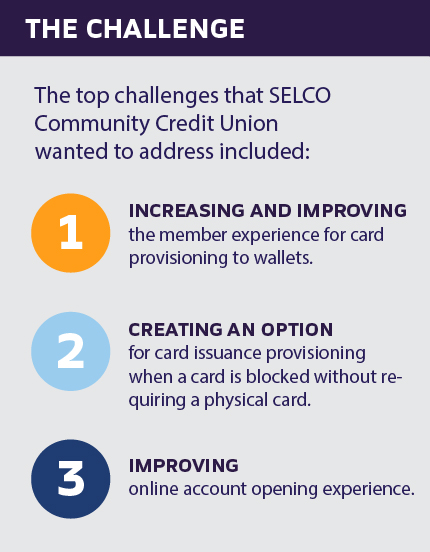

SELCO Community Credit Union was eager to enhance its digital services for its members. By adopting digital issuance, SELCO was no longer limited to issuing cards via mail or by instant issuing their cards at branch locations. Their goal was to provide members with a seamless and convenient experience while maintaining security and accessibility for their digital service offerings.

The Results

The MAP Project Implementation Team understood that SELCO Community Credit Union needed to improve their digital service offerings and was there to help them throughout the entire process. SELCO began working with MAP to understand functionality within core banking and digital banking costs.

They decided to provision their mobile wallets through the Visa SDK. Then, they assessed the business case, pricing, and fraud mitigation strategies, working with the MAP Project Implementation Team to outline the project timeline and initiate a successful digital issuance offering.

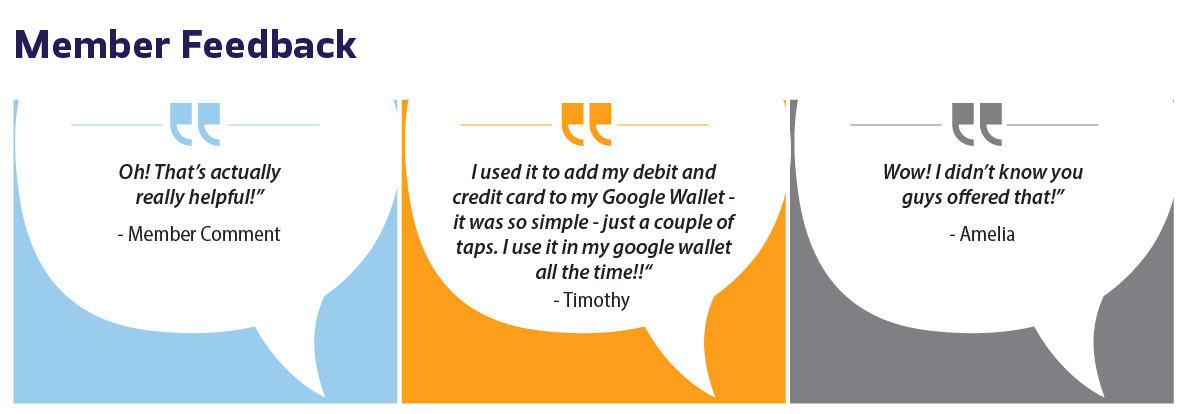

After the project implementation was complete, SELCO saw an increase in their members’ mobile wallet provisioning while also significantly improving their member experience and perspective of SELCO.

About Selco Community Credit Union

SELCO Community Credit Union is one of the largest and longest-standing Oregon-based credit unions with more than $2.7 billion in assets and more than 150,000 members. Founded nearly 90 years ago by a group of fiscally minded teachers, membership to the Springfield-based credit union is available to anyone who lives or works in one of the 27 Oregon or eight Washington counties SELCO serves. Learn more about SELCO at selco.org.