Simplifying IT

for a complex world.

Platform partnerships

- AWS

- Google Cloud

- Microsoft

- Salesforce

Working with industry-leading technology companies and service providers, we leverage core competencies to deliver the most innovative and practical solutions to client credit unions.

We provide comprehensive training for the life of our agreement with client credit unions. MAP is your first point of contact for all your training, client services and implementation research.

MAP is able to offer the best service in the industry because we understand that the latest technology and lowest price only have value to a credit union when combined with meaningful service. In short, we “get it.” Credit unions have limited time and resources to invest in card processing and network services and they need more than a provider. They need an advocate.

Member Access Processing provides world-class 24/7 cardholder support services from Visa’s U.S. and international call centers. The call center can provide account support for card activation, hot carding, Verified by Visa, turnkey fraud monitoring and case management using Falcon Fraud Manager as well as handily Dispute Services and Mobile Wallet services issues. The call center support is available on a 24x7x365 basis. Member cardholders may also access automated VRU system 24x7x365.

Call Center Services include:

From basic cardholder or account number search to robust name search capabilities, it’s easy to find and work with the data you need.

See a comprehensive history of any actions taken on your cardholder and who performed them.

The integration of Card & Account Maintenance with our risk management system allows you to limit fraud monitoring for a specified period while a cardholder is traveling.

MAP’s Payment Companion App is a secure and scalable mobile payment app solution that makes it easy for you to offer cardholders a more connected experience throughout the entire payment lifecycle. Hosted and managed by Visa, this white-label solution for debit, credit, and prepaid card services is a great way to increase the profitability of your card portfolio, extend your mobile footprint, and deepen your customer relationships.

The strategy is simple — help your members manage and protect their cards so they are more likely to use them. At the same time, you’re implementing a solution that ensures you’re ready for future e-commerce and mobile payments services. With MAP Mobile Card Services your cardholders have the convenience of an easy to use app, fast access to balance information, proactive alerts to help minimize fraud, and, for prepaid cards, an easy way to add funds. For your institution, this means greater likelihood of top-of-wallet positioning and a powerful complement to your online and mobile banking efforts.

The Digital Member Service platform empowers credit unions to more easily interact and co-pilot their member’s experience, enabling a better and, ultimately, more successful communication experience.

Key Features and Benefits to Support your Credit Union Members

Call Visualizer

Call Visualizer helps you improve first-call resolution, average handle time, and customer satisfaction. Empower your representatives to add immediate context to any phone conversation by tying offline phone calls to live web sessions where they can take advantage of live observation, CoBrowsing, video & surveys. Call Visualizer is designed to work with your existing phone system and embed within your CRM and business applications. It delivers rich visual engagement to your agents, allowing them to have instant live observation and full, dual-cursor CoBrowsing capabilities to better support customers. With the click of a button, Call Visualizer allows you to transform any support call into a fully immersive visual engagement with rich context for faster and more intelligent conversations. Agents can deliver a more personal touch by adding one-way or two-way video to phone conversations.

AI Management AI

Management module provides the framework to provision, measure, and manage AI-driven Virtual Assistants to converse with your customers, and Operator Assistants to guide agents.

Deploy AI in Different Ways

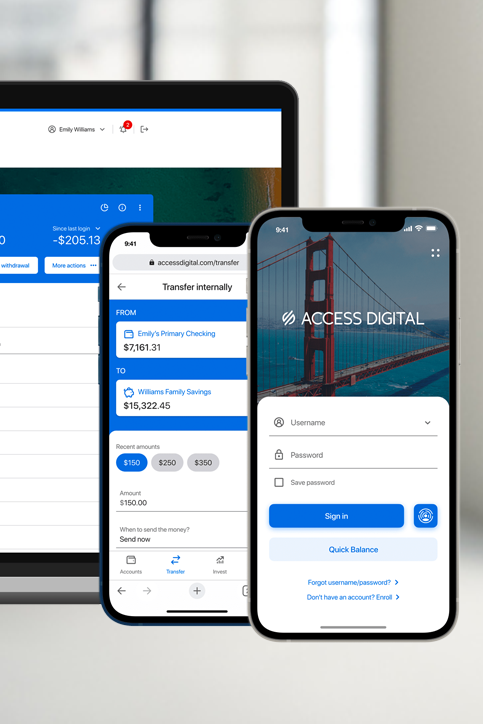

The Digital Member Banking platform from Access Softek offers an enterprise suite of online and mobile banking solutions co-created actual end users. We shadowed support staff at call centers to streamline the troubleshooting process. Ongoing usability studies ensure that we address user pain points while field-testing new ideas and designs.

The result of this close collaboration is unlike any other online and mobile banking solution. Ii is a state-of-the-art vision of cross-channel accessibility helps you meet your members wherever they prefer to bank: online, through native mobile apps and mobile browsers, and even on wearables like Apple Watch. Thanks to the native application architecture, designed completely in-house for a consistent and unified vision, every user touchpoint experience feels native to that device for an optimized user experience.

Commercial Banking Platform

Access Softek’s business banking solution provides an easy way for local business owners to quickly, easily and securely get a clear picture of their business finances 24/7. The solution can be tailored to meet the business account requirements of your business members, whether they have one location or 100+ or they are cash, check or payables intensive.