CASE STUDY

UNIFY Financial Credit Union reports a reduction in transactional fraud losses and maintenance of a positive customer experience with Visa DPS Risk Advisor

Opportunity

As one of the nation’s leading credit unions, UNIFY Financial Credit Union’s goal is to allow members to connect to their money with peace of mind. Security is fundamental to UNIFY’s mission, which has more than 300,000 members and offers branch access nationwide—a business model that distinguishes it in the market.

In 2023, UNIFY reported a BIN attack via enumeration, and utilized the event to assess and bolster its overall fraud risk protocols, including transactional fraud monitoring. UNIFY has significant card activity for an organization of its size. In addition, it wanted to ensure best practices and extend visibility across its card portfolio, as well as gain insight into global trends. UNIFY determined that this objective would require external resources.

The Solution

UNIFY, working through its card processing provider, Member Access Processing (MAP), engaged the Visa DPS Risk Advisor Team (Visa RA Team) to assess and extend its fraud monitoring and mitigation capabilities. The Visa RA Team supports financial institutions by optimizing fraud management & mitigation performance utilizing global Visa resources, providing customized near real-time rule strategies, regular fraud reviews and comprehensive performance reporting to help reduce exposure to risk and ease operational burden.

UNIFY has a designated Visa DPS Risk Advisor fraud consultant, who serves as a single point of contact. The consultant works with UNIFY to develop and evolve a comprehensive fraud strategy, maintains rulesets and conducts a monthly rule audit.

Visa DPS Risk Advisor also provides segmented high-risk authorization monitoring every 4 hours, around the clock, including holidays and weekends, implementing rules for anomalous or suspicious activity immediately. This proactive and prescriptive action identifies fraud trends faster, significantly reducing delays related to TC40 fraud reporting trending. In addition, Visa DPS Risk Advisor utilizes its Global Ecosystem Intelligence Teams, Payment Fraud Disruption Teams and other resources to provide UNIFY with a holistic, global perspective on fraud trends for more effective strategies.

The Results

UNIFY has reported improvement in its transactional fraud monitoring capabilities and effectiveness in several ways, including:

Reducing credit card fraud losses while maintaining a high authorization approval rate.

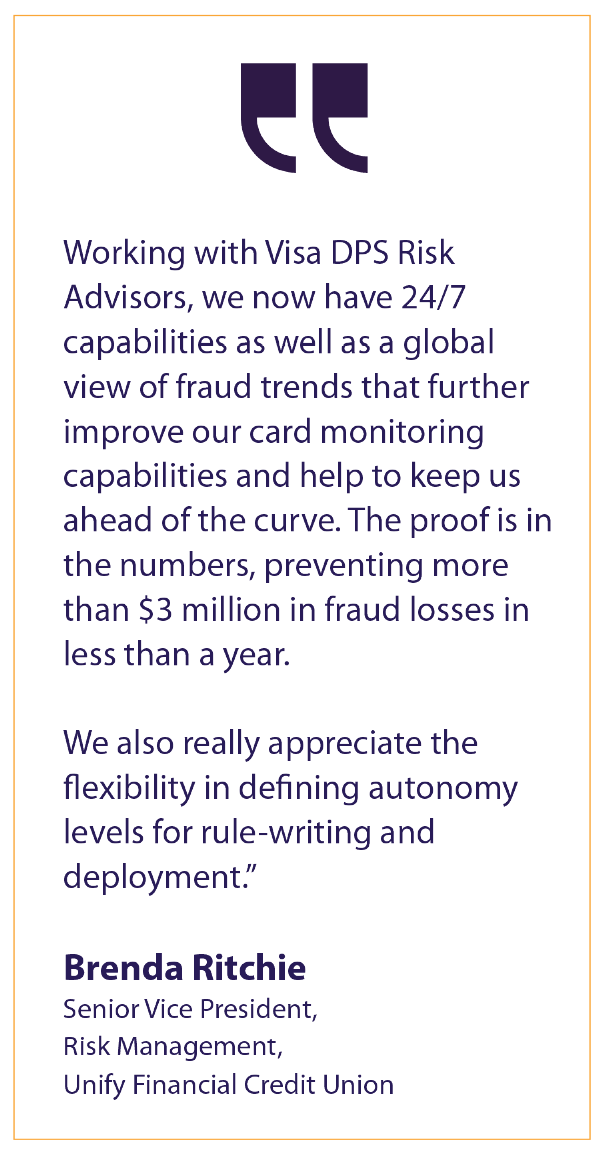

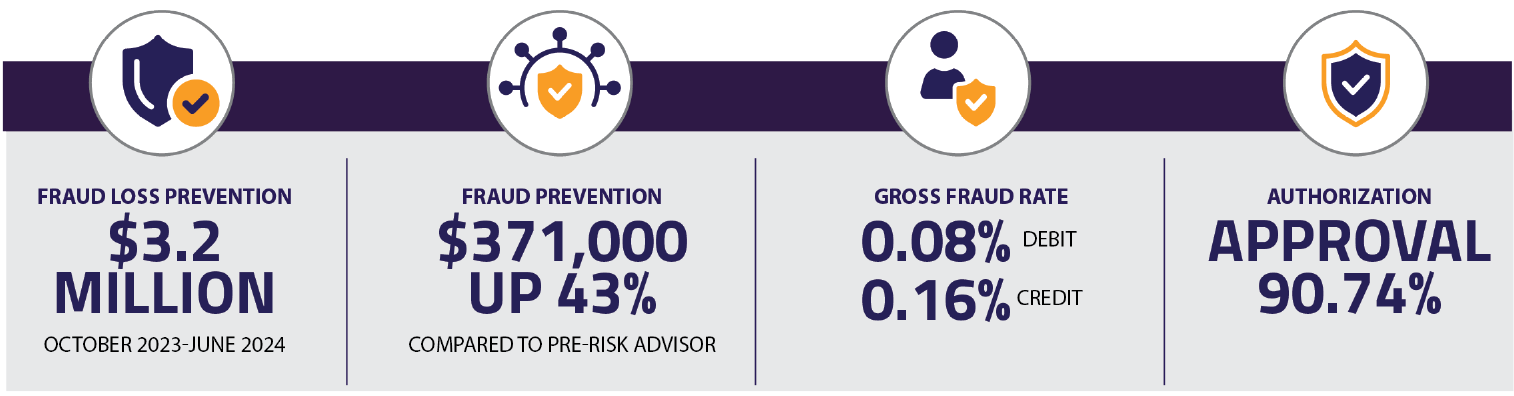

First, 24/7 monitoring and comprehensive, real-time oversight enable swift action. In the first nine months of working with the Visa RA Team, UNIFY reported prevention of about $3.2 million in fraud losses, a 43% increase in prevention effectiveness. Today, UNIFY has one of the lowest gross debit fraud rates of issuers using Visa Risk Advisor. As important, UNIFY achieved these improvements without compromising its authorization approval rate, and reported maintaining a positive member experience.

Optimizing internal resources.

By entrusting the Visa RA Team with transactional fraud monitoring and rule management, UNIFY has freed internal risk resources for additional initiatives.

Gaining actionable insight.

The service provides UNIFY with extensive analytics capabilities, as well as valuable context and insight needed to effectively interpret and act on the metrics.

Achieving global fraud intelligence and perspective. Visa RA Team enabled UNIFY to move beyond an isolated view of fraud trends and gain the holistic, global insight that it requires to ensure rigorous card fraud monitoring in today’s elevated threat landscape.