Simplifying IT

for a complex world.

Platform partnerships

- AWS

- Google Cloud

- Microsoft

- Salesforce

Working with industry-leading technology companies and service providers, we leverage core competencies to deliver the most innovative and practical solutions to client credit unions.

We provide comprehensive training for the life of our agreement with client credit unions. MAP is your first point of contact for all your training, client services and implementation research.

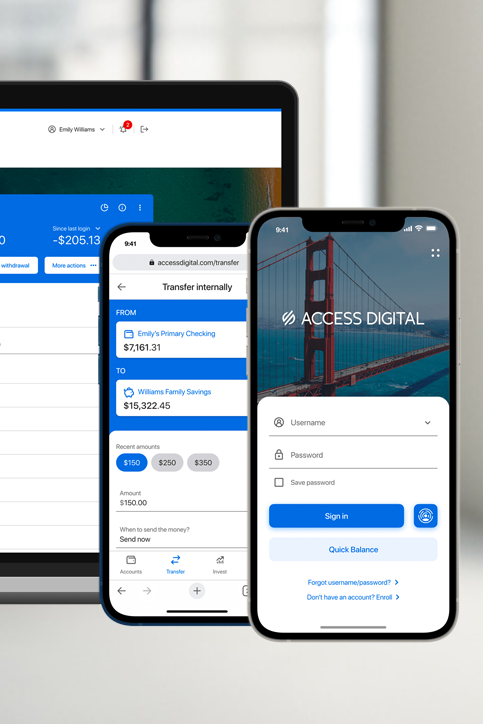

The Digital Member Banking platform from Access Softek offers an enterprise suite of online and mobile banking solutions co-created actual end users. We shadowed support staff at call centers to streamline the troubleshooting process. Ongoing usability studies ensure that we address user pain points while field-testing new ideas and designs.

The result of this close collaboration is unlike any other online and mobile banking solution. Ii is a state-of-the-art vision of cross-channel accessibility helps you meet your members wherever they prefer to bank: online, through native mobile apps and mobile browsers, and even on wearables like Apple Watch. Thanks to the native application architecture, designed completely in-house for a consistent and unified vision, every user touchpoint experience feels native to that device for an optimized user experience.

Access Softek’s business banking solution provides an easy way for local business owners to quickly, easily and securely get a clear picture of their business finances 24/7. The solution can be tailored to meet the business account requirements of your business members, whether they have one location or 100+ or they are cash, check or payables intensive.

The Visa Token Service (VTS) is technology from Visa that replaces sensitive account information, such as the 16-digit primary account number, with a unique digital identifier called a token. The token allows payments to be processed without exposing actual account details that could potentially be compromised. Issuers, merchants, and wallet providers can deliver secure mobile payment applications, gain access to third-party digital payment experiences, or securely maintain cards on file in order to offer their customers safe ways to shop online and with mobile devices.

Visa Token Service provides the payment ecosystem with a flexible and scalable way to securely provision and manage digital credentials (tokens) across remote (e-Commerce and m-Commerce) and mobile contactless form factors. In order for payment tokens to provide improved protection against misuse, the token is limited to use in a specific domain, such as token requester, mobile device, merchant, transaction type, or channel.

MAP fully supports credential enrollment of digital wallets (Apple Pay, Google Pay, Samsung Pay). Once a cardholder has provisioned the digital wallet, MAP may optimally perform verification and authentication steps to ensure the cardholder’s identity and the validity of the payment credentials, allowing the cardholder to use their payment credentials stored within the wallet to make transactions. Once completed, the cardholder can initiate payments at supported merchants, online platforms, or in-person, depending on the capabilities of the wallet and the acceptance infrastructure.

MAP currently offers Biometric Authentication Manager (BAM), a solution that allows call center and other support staff to trigger biometric authentication on a caller’s mobile app based on the biometrics native to all Apple and Android smartphones. Within a few seconds the caller is authenticated and staff can move directly to fulfilling on the caller’s requested service. It is familiar, trusted and accepted by nearly all consumers.

The online account opening platform Access Softek helps credit union approve more applicants while minimizing risk by using alternative identity verification methods that integrate with service bureaus. The platform incorporates AI and machine learning to automatically detect and prevent fraud via ID and facial image recognition, behavioral analysis, and text/document recognition. The account opening process truly integrates and automates third parties so that key steps like e-sign and funding holds are completed in real time, without requiring applicants to leave their application or return after a delay. With analytics and A/B testing, plus the ability to set up multiple account-opening experiences, your credit union can deliver the best possible experience to your prospective members.

The MAP lending platform powered by Access Softek works on both mobile and online channels to identify eligibility for pre-approved and short-term loans, photo balance transfers, credit cards, and traditional options like vehicle, personal, and home equity loans. The Lending solution helps you increase loans, expand your banking channels, and provide one-stop 24/7 loan services. A rules-based decision engine drives identification of automatically eligible users. It can approve loans immediately and deposit funds to accounts. Pre-populated applications ensure accuracy and speed. Users can save application information so even more data pre-populates their next loan.

The the first robo-advisor designed to seamlessly integrate with any bank and credit union online and mobile banking platform. It provides the services of a personal banker via automation and algorithm-based financial planning services. This automation provides community institutions a tool to tap into the $73 trillion investment market and provide wealth-building services traditionally dominated by investment firms, fintechs and large national banks. EasyVest YourChoice can work on its own, but is best used as part of our more extensive Access Digital Investment suite, which includes EasyVest® Automated.

Research suggests that turning cards on and off at the mobile app is fast becoming a favorite tool for members to protect their accounts from unauthorized use. Consumers are demanding self-service tools to combat fraud. With Card Control, your members can switch their cards on and off from their smartphone and the status is changed immediately. Members can choose to keep a card active within a specific region or when they are in the presence of their phone. They can even choose specific merchant categories to enable and disable.

Empower members to control how, when, and where their cards are used with Consumer Transaction Controls (CTC), credit unions can offer their cardholders the ability, via their mobile banking application or online website, to set restrictions and alerts on how their cards are used. Cardholders can define spending limits, impose channel restrictions (e.g., no e-commerce), prohibit international transactions or temporarily suspend their card’s use if ever misplaced or lost/stolen. CTC increases card security and helps customers to better manage their card spending, while building trust and card preference.

Transaction Alerts gives members a near real-time view of the transactions conducted on their enrolled Visa cards. With transaction alerts, they can more actively manage their personal finances and catch fraudulent activity early. Cardholders can select the types of alerts and the threshold settings that will trigger personalized notifications to them through their preferred delivery channel.

The following Instant Issue processes can be completed in real-time when a customer opens a new account: