MAP Announces Results of Annual Client Survey

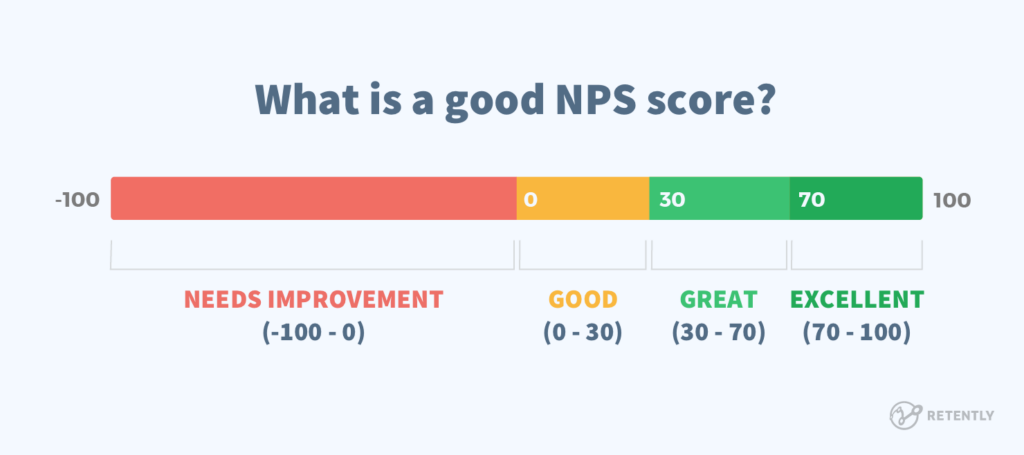

Seattle, Wash. – March 12, 2025 – Member Access Processing (MAP), the leading provider of the Visa DPS Debit, Credit, ATM, and Digital Payment Processing platform to credit unions nationwide, announced the results of its Annual Client Survey this week with the CUSO scoring 53.42 on the Net Promoter Score (NPS) question of likelihood to refer. MAP conducts the client survey annually and achieved a response rate of 52% with comments and feedback being provided by 78 respondents representing 31 of MAP’s 46 client credit unions.

This year’s survey was retooled to include fewer questions and the addition of an option for respondents to provide comments and feedback on each question. This NPS score marks a drop since 2023, however, the survey response rate also doubled from prior years.

An NPS score of between 30 and 70 is great according to Retently, a customer service software company. However, the company stresses that though the NPS number is important, the real value lies in how a company uses the qualitative feedback to improve the customer experience.

“We are extremely pleased with the results,” said Steve Bone, President/CEO of MAP. “Our clients were very clear with their feedback that they believe we are on the right road – growing and living up to our market position of being a challenger brand, and to continue our business model of being a CUSO helping our clients serve their members and grow their card portfolios.”

Themes that emerged from the feedback include: maintaining service ratio guarantee through growth, continuing to prioritize delivery, increasing client advocacy in the credit union industry and payments landscape, and continuous improvement with communication and responsiveness for clients.

“We conduct our Client Survey with the idea that we really want to hear from our clients.” Steve Bone explained, “The NPS score is important to us and despite the decline this year, we celebrate these results because the candid feedback and engagement from our clients is invaluable. The qualitative responses allow us to understand where gaps exist so we can address them to be a better partner and do a better job of serving our clients.”

MAP conducts its Client Survey each year during the first quarter to assess client satisfaction, service quality, products and services offerings, and areas for improvement from the previous year.

About Member Access Processing (MAP)

Member Access Processing (MAP) provides credit unions with an advocate of their own when it comes to payment processing. As a Credit Union Service Organization (CUSO), our sole focus is helping credit unions serve their members and grow their card portfolios. For over 25 years, MAP has been the credit union payment processor of choice for Visa DPS, providing credit unions with single-point access to all the payment technologies, training, and education that Visa® offers.