Simplifying IT

for a complex world.

Platform partnerships

- AWS

- Google Cloud

- Microsoft

- Salesforce

Working with industry-leading technology companies and service providers, we leverage core competencies to deliver the most innovative and practical solutions to client credit unions.

We provide comprehensive training for the life of our agreement with client credit unions. MAP is your first point of contact for all your training, client services and implementation research.

MAP offers a variety of flexible risk management solutions to help your credit union reduce losses and lower administrative expense associated with managing fraud.

Our services are tailored to your institution’s needs, risk characteristics, and goals. By combining processing scale, advanced technology, and years of risk management experience, we can provide you with a complete fraud management program at an affordable cost.

We work closely with you to identify your risk management needs and then provides tools and controls to actively manage payment system risk.

MAP’s fraud detection services use Falcon Fraud Manager in conjunction with the Visa Advanced Authorization service, to recognize complex, hidden fraud patterns as well as emerging schemes while minimizing interference with legitimate transactions.

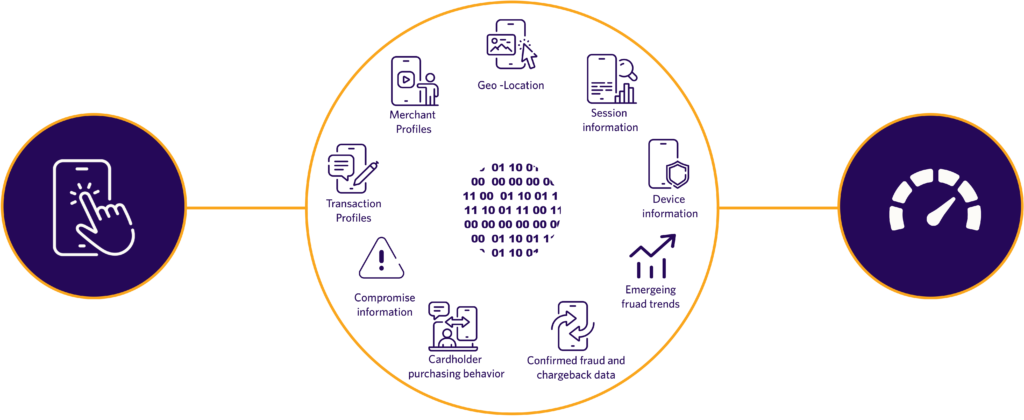

Using best-in-class machine learning technology, VAA is a risk evaluation system that provides risk information directly for all VisaNet-processed authorizations VAA scores all Visa transactions and enables issuer real-time decisions to prevent losses with the first transaction and enhance the security of Visa payment card authorizations. VVA's risk information empowers credit unions to take appropriate action based on their authorization risk strategies and parameters across the suite of Risk Management offered by MAP.

MAP employs the FICO Falcon Fraud Manager, a neural network platform that performs sophisticated fraud scoring to capture relationships and patterns often missed by traditional fraud detection methods. This advanced system enables a credit union to design customized anti-fraud strategies to successfully detect and stop potentially fraudulent activity.

Falcon Fraud Call Center provides a credit union with outbound and inbound call support for member cardholders to help minimize fraud occurrences. The Fraud Call Center monitors cases created by the Falcon Fraud Manager rules engine in combination with the Visa Advanced Authorization neural network. Fraud cases resulting from this process are passed to a predictive dialer, which then initiates outbound calls or text messages to your cardholders. The Call Center is open 7 x 24 x 365.

Managed Real-Time Decisioning, a real-time rule strategy based on actual performance and configurable for your business. Rather than simply targeting rules to current fraud patterns and trends, our real-time decisioning solution uses multi-faceted risk intelligence data and actual false positive rate performance to determine the most effective real-time decline strategies to help you reduce fraud.

Risk Advisor is a full-service fraud solution that provides clients consulting services and regular reviews to discuss fraud trends and overall performance including custom-designed monthly reporting and performance insights into benchmarking, authorization, and fraud information across a variety of segments. It includes customized real-time decline ruleset based on client input on risk tolerance and fraud profile and comprehensive monitoring of defined, higher risk transaction segments every day, including weekends and holidays.

Sonar can help a credit union identify compromised cards earlier than some traditional tools like network alerts. MAP Sonar leverages machine learning and transaction and fraud data from a consortium of thousands of financial institutions. Sonar provides the Fraud Forecaster score which is the likelihood a card will experience fraud in the next 90 days, enabling the MAP analyst to provide reissue recommendations that align with the credit union’s goals.

Our on-behalf-of service provides you a prioritized list of potential compromised cards for any action based on your risk strategy. Finally, it provides actionable insights on network alerts and helps reduce unnecessary card reissues. Paired with MAP’s expertise and unmatched service, Sonar helps you reduce fraud, unnecessary reissuance, and member impact.

Risk Services Manager (RSM) provides an easy-to-use rules engine to help catch and block suspect transactions. These rules may be used alone or in conjunction with Falcon Fraud Manager and are especially effective at catching unique fraud incidents, enabling a credit union to stop authorization requests prior to approval.

MAP works with our credit unions to leverage RSM custom rule functionality to tactically target fraud scenarios – typically before a fraud incident affects your portfolio.

Issuer Cardholder Authentication Service (ICAS) is part of a multi-layered risk strategy which seeks to mitigate risk in the Card Not Present (CNP) environment. Authentication occurs prior to the Authorization and uses 3D Secure to assess the risk of a transaction, in real-time, using predictive risk analysis based on enhanced inputs, including device and transaction information and consumer behaviors. Its purpose is to assess the risk and to decide if the party making the purchase is the true party and what additional authentication is needed. ICAS adds an additional layer of security against online fraud, while minimizing friction during the checkout process. ICAS allows low -risk transactions to process without the need for additional verification, minimizing disruption and abandonment at the point of purchase and providing a better experience for the member and the potential for increased profits for the credit union.

MAP offers multiple authorization options and mitigation solutions to minimize your institution’s exposure to fraud. For greater card program protection and reduced fraud, these programs support valid authorization reporting for a credit union: