-

Authorization ProcessingAuthorization Processing

-

Risk ManagementRisk Management

-

Network GatewayNetwork Gateway

-

MAP PlasticsMAP Plastics

-

Instant IssuanceInstant Issuance

-

Buy Now Pay LaterBuy Now Pay Later

-

Reports & AnalyticsReports & Analytics

-

Prepaid (GPR)Prepaid (GPR)

-

Gift CardsGift Cards

-

Prepaid Virtual CardsPrepaid Virtual Cards

-

Ready Link NetworkReady Link Network

-

Call Center SupportCall Center Support

-

Campaign SolutionsCampaign Solutions

-

ATM Terminal DrivingATM Terminal Driving

-

Digital Member ServiceDigital Member Service

-

Loyalty RewardsLoyalty Rewards

-

Dispute ManagementDispute Management

-

Payment Companion AppPayment Companion App

-

Omni Channel BankingOmni Channel Banking

-

Digital CredentialsDigital Credentials

-

Account OpeningAccount Opening

-

Online Lending/EasyVestOnline Lending/EasyVest

-

Card Controls & AlertsCard Controls & Alerts

-

APIs/SDKsAPIs/SDKs

-

Implementations/ConversionsImplementations/Conversions

-

Testing & CertificationTesting & Certification

-

ISO 8583 & 20022 formatsISO 8583 & 20022 formats

-

Card & Account MaintenanceCard & Account Maintenance

-

Card FulfillmentCard Fulfillment

-

Instant IssuingInstant Issuing

-

Prepaid IssuingPrepaid Issuing

-

User Interface (CATS)User Interface (CATS)

-

Falcon/VAAFalcon/VAA

-

Managed Real-TimeManaged Real-Time

-

Sonar ForecasterSonar Forecaster

-

Risk Service ManagerRisk Service Manager

-

Visa Secure (ICAS)Visa Secure (ICAS)

-

Other Risk ToolsOther Risk Tools

-

Dispute SupportDispute Support

-

Member SupportMember Support

-

Transaction ResearchTransaction Research

-

ATM Terminal DrivingATM Terminal Driving

-

ATM AdministrationATM Administration

-

Surcharge-Free NetworksSurcharge-Free Networks

-

ATM System MonitoringATM System Monitoring

-

Call CenterCall Center

-

Mobile Digital AppMobile Digital App

-

Digital Member SupportDigital Member Support

-

Omni Channel BankingOmni Channel Banking

-

On-demand ReportsOn-demand Reports

-

Visual & Data Insights (VDM)Visual & Data Insights (VDM)

-

Data AnalyticsData Analytics

-

MAP Campaign SolutionsMAP Campaign Solutions

-

Visa Campaign SolutionsVisa Campaign Solutions

-

ATM CampaignsATM Campaigns

-

Single-Point SettlementSingle-Point Settlement

-

Daily SettlementDaily Settlement

-

Transparent BillingTransparent Billing

Working with industry-leading technology companies and service providers, we leverage core competencies to deliver the most innovative and practical solutions to client credit unions.

MAP Training Solutions

We provide comprehensive training for the life of our agreement with client credit unions. MAP is your first point of contact for all your training, client services and implementation research.

Training Center

-

TutorialsTutorials

-

User GroupsUser Groups

Visa University

-

Visa OnlineVisa Online

-

CalendarCalendar

-

CoursesCourses

-

FAQFAQ

-

Whitepapers and Case StudiesWhitepapers and Case Studies

Payment Integration

With MAP, you get a processing platform that leverages cutting-edge technology and provides exceptional service. We are a proven thought leader, evidenced by our position at the forefront of payment innovation, and strive to help you gain long-term success. Working with our partners, MAP connect credit union to a payments universe, supporting an institution’s full spectrum of payment processing needs.

For more than a quarter century, we’ve worked hard to make processing easier for credit unions. With MAP, our clients stay innovative, stay agile and deliver at scale. In today’s market, this is a critical need. We provide our clients with a comprehensive solution and single point of access to Visa payment products and services, as well as other global capabilities.

APIs and SDKs

Open up a new world of possibilities with MAP's Developer Tools & Solutions

APIs make it possible for applications to interact and share data with each other. MAP partners with Visa and Visa DPS to offer a full suite of APIs, which enable our clients and vendors to share data as appropriate for their business needs.

In consultation with your core software provider and your digital asset vendor, MAP can outline a strategy for launching the applicable APIs. Available Visa APIs and technical specifications are available via the Visa Developer Center (developer.visa.com).

The Visa API set includes:

- Transaction Alerts

- Consumer Transaction Controls

- Visa Token Service

- Visa Risk Manager

- Visa Direct

Visa DPS API set includes:

- Falcon List

- Card & Account Maintenance

- VROL for DPS

Implementations and Conversions

MAP is uncompromising in providing successful conversions.

MAP prides itself on the comprehensive nature of its product implementations and core conversions. Working with a dedicated implementation manager, the credit union with be entrusted to time-tested methodologies and innovative approaches to result in a successful conversions.

Key activities include requirements definition, application configuration, certification, change management, pilot, and production phases. Your manager will take care to coordinate support from pertinent vendors and partners, provide go-live support to ensure that the change is invisible to your cardholders, document implementation details, and ensure a smooth transition from the implementation process to ongoing production support.

You’re always in good hands when working with the MAP Implementations Team.

Testing and Certification

Delivering confidence with MAP's Robust & Thorough testing and certification

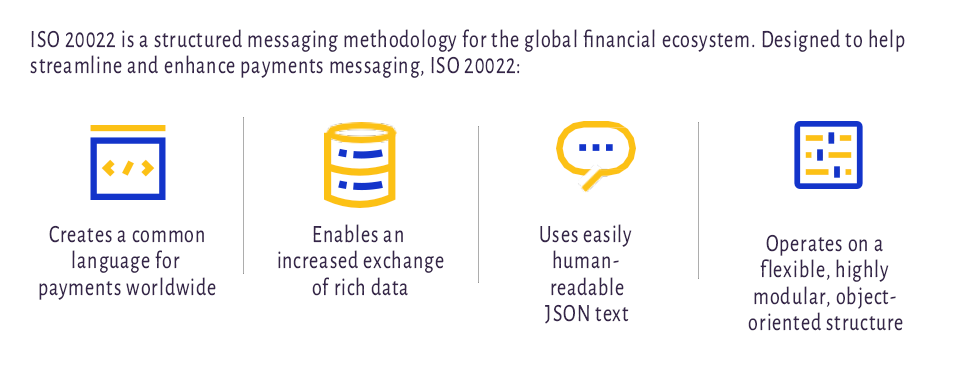

ISO 8583 and ISO 2002

MAP is Miles Ahead of the competition

Future Ready

ISO 20022 represents an evolutionary leap in payments communication. Similar to how streaming video platforms won out over brick-and-mortar video rental stores by offering a better, faster and more accessible user experience, ISO 20022 is the next generation of financial messaging, allowing for the expansion of data elements currently not available through the ISO 8583 payload, opening up opportunities for new use cases. ISO 20022 provides a cleaner, easier-to-use messaging standard that is significantly more versatile and user-friendly than the legacy ISO 8583 standard initially developed in the 1980s.

Our processing partner, Visa DPS, has been designing solutions and building messages in the ISO 20022 standard for more than three years, providing input and feedback to the ISO 20022 working group that has influenced message content and informed the ongoing development of the standard. As a market leader in ISO 20022 integration and development, Visa DPS is working with MAP to help guide credit unions as they start preparing for adoption.

Need help? We’re happy to answer any questions you may have and help you improve your credit union’s card processing services.