-

Authorization ProcessingAuthorization Processing

-

Risk ManagementRisk Management

-

Network GatewayNetwork Gateway

-

MAP PlasticsMAP Plastics

-

Instant IssuanceInstant Issuance

-

Buy Now Pay LaterBuy Now Pay Later

-

Reports & AnalyticsReports & Analytics

-

Prepaid (GPR)Prepaid (GPR)

-

Gift CardsGift Cards

-

Prepaid Virtual CardsPrepaid Virtual Cards

-

Ready Link NetworkReady Link Network

-

Call Center SupportCall Center Support

-

Campaign SolutionsCampaign Solutions

-

ATM Terminal DrivingATM Terminal Driving

-

Digital Member ServiceDigital Member Service

-

Loyalty RewardsLoyalty Rewards

-

Dispute ManagementDispute Management

-

Payment Companion AppPayment Companion App

-

Omni Channel BankingOmni Channel Banking

-

Digital CredentialsDigital Credentials

-

Account OpeningAccount Opening

-

Online Lending/EasyVestOnline Lending/EasyVest

-

Card Controls & AlertsCard Controls & Alerts

-

APIs/SDKsAPIs/SDKs

-

Implementations/ConversionsImplementations/Conversions

-

Testing & CertificationTesting & Certification

-

ISO 8583 & 20022 formatsISO 8583 & 20022 formats

-

Card & Account MaintenanceCard & Account Maintenance

-

Card FulfillmentCard Fulfillment

-

Instant IssuingInstant Issuing

-

Prepaid IssuingPrepaid Issuing

-

User Interface (CATS)User Interface (CATS)

-

Falcon/VAAFalcon/VAA

-

Managed Real-TimeManaged Real-Time

-

Sonar ForecasterSonar Forecaster

-

Risk Service ManagerRisk Service Manager

-

Visa Secure (ICAS)Visa Secure (ICAS)

-

Other Risk ToolsOther Risk Tools

-

Dispute SupportDispute Support

-

Member SupportMember Support

-

Transaction ResearchTransaction Research

-

ATM Terminal DrivingATM Terminal Driving

-

ATM AdministrationATM Administration

-

Surcharge-Free NetworksSurcharge-Free Networks

-

ATM System MonitoringATM System Monitoring

-

Call CenterCall Center

-

Mobile Digital AppMobile Digital App

-

Digital Member SupportDigital Member Support

-

Omni Channel BankingOmni Channel Banking

-

On-demand ReportsOn-demand Reports

-

Visual & Data Insights (VDM)Visual & Data Insights (VDM)

-

Data AnalyticsData Analytics

-

MAP Campaign SolutionsMAP Campaign Solutions

-

Visa Campaign SolutionsVisa Campaign Solutions

-

ATM CampaignsATM Campaigns

-

Single-Point SettlementSingle-Point Settlement

-

Daily SettlementDaily Settlement

-

Transparent BillingTransparent Billing

Working with industry-leading technology companies and service providers, we leverage core competencies to deliver the most innovative and practical solutions to client credit unions.

MAP Training Solutions

We provide comprehensive training for the life of our agreement with client credit unions. MAP is your first point of contact for all your training, client services and implementation research.

Training Center

-

TutorialsTutorials

-

User GroupsUser Groups

Visa University

-

Visa OnlineVisa Online

-

CalendarCalendar

-

CoursesCourses

-

FAQFAQ

-

Payments Report - NewslettersPayments Report - Newsletters

-

CUSO News - MAP BlogCUSO News - MAP Blog

-

Client Success - Case StudiesClient Success - Case Studies

-

Thought Leadership - White PapersThought Leadership - White Papers

-

NewsroomNewsroom

Risk Management

MAP offers a variety of flexible risk management solutions to help your credit union reduce losses and lower administrative expense associated with managing fraud.

Our services are tailored to your institution’s needs, risk characteristics, and goals. By combining processing scale, advanced technology, and years of risk management experience, we can provide you with a complete fraud management program at an affordable cost.

We work closely with you to identify your risk management needs and then provides tools and controls to actively manage payment system risk.

Falcon & VAA Risk Intelligence

Protecting member cardholders in Real Time

Visa Advanced Authorization (VAA)

Using best-in-class machine learning technology, VAA is a risk evaluation system that provides risk information directly for all VisaNet-processed authorizations VAA scores all Visa transactions and enables issuer real-time decisions to prevent losses with the first transaction and enhance the security of Visa payment card authorizations. VVA's risk information empowers credit unions to take appropriate action based on their authorization risk strategies and parameters across the suite of Risk Management offered by MAP.

Falcon Fraud Manager

MAP employs the FICO Falcon Fraud Manager, a neural network platform that performs sophisticated fraud scoring to capture relationships and patterns often missed by traditional fraud detection methods. This advanced system enables a credit union to design customized anti-fraud strategies to successfully detect and stop potentially fraudulent activity.

Falcon Fraud Call Center Service

Falcon Fraud Call Center provides a credit union with outbound and inbound call support for member cardholders to help minimize fraud occurrences. The Fraud Call Center monitors cases created by the Falcon Fraud Manager rules engine in combination with the Visa Advanced Authorization neural network. Fraud cases resulting from this process are passed to a predictive dialer, which then initiates outbound calls or text messages to your cardholders. The Call Center is open 7 x 24 x 365.

Managed Real-Time / Risk Advisor

Managed Real-Time Decisioning, a real-time rule strategy based on actual performance and configurable for your business. Rather than simply targeting rules to current fraud patterns and trends, our real-time decisioning solution uses multi-faceted risk intelligence data and actual false positive rate performance to determine the most effective real-time decline strategies to help you reduce fraud.

Risk Advisor is a full-service fraud solution that provides clients consulting services and regular reviews to discuss fraud trends and overall performance including custom-designed monthly reporting and performance insights into benchmarking, authorization, and fraud information across a variety of segments. It includes customized real-time decline ruleset based on client input on risk tolerance and fraud profile and comprehensive monitoring of defined, higher risk transaction segments every day, including weekends and holidays.

Sonar Fraud Forecaster

A Proactive Approach to Card Fraud

- Identifies cards at highest risk of fraud to enable immediate action

- Detects large and small compromised accounts that major networks overlook

- Employs advanced analytics to identify card fraud

Risk Services Manager

MAP offers credit unions World Class plastics and fulfillment

- Easy to Use—Create and edit rules without having to know any specialized scripting language.

- Anytime Access—With 24/7 availability you can develop and test rules quickly and conveniently to respond to changing needs.

- Test Rules—Model and refine your rules based on performance against historical transactions and gain greater assurance that the rules you implement are effective.

- Deploy Rules Quickly—Rules that have passed testing are deployed to production use within one hour.

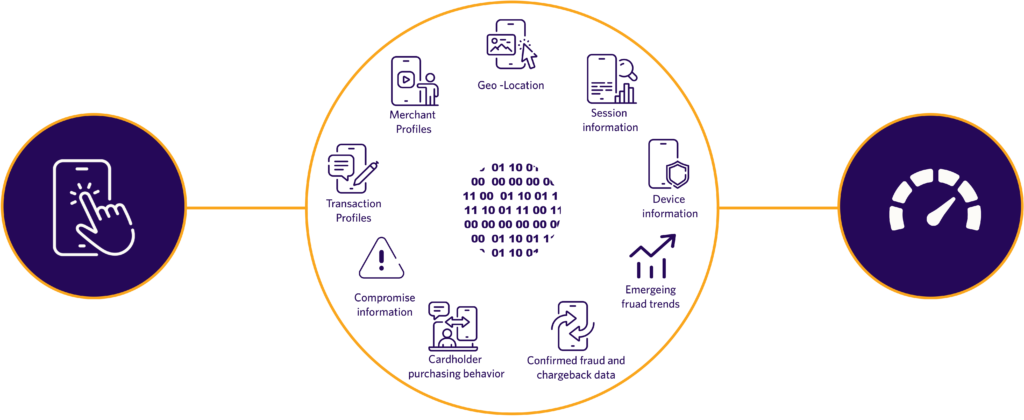

Visa Secure (ICAS)

- No development required between host system, the ACS (access control server) and MAP/Visa – we’ve already done that for you!

- No development required for migration

- Optional One-time Passcode (OTP) challenge feature to improve higher transaction completion rate and improved member experience

Elements feeding ICAS Risk Authentication Score

Other Risk Tools

- Authorization edit checks provides risk edits and authorization processing options to reduce fraud exposure.

- Address Verification Service (AVS) enables merchants to confirm a cardholder’s billing address to prevent fraud in the card-not-present environment.

- CAMS Alert Service notifies financial institutions of accounts that are at risk due to a compromise event. Issuers can optionally use this information to make informed decisions about their at-risk accounts. MAP supports an Auto Upload Service that allows Visa to transmit CAMS alerts directly to DPS, which automatically uploads them and makes them available to the risk mitigation tools, RSM or Flash Fraud rules.

- Cardholder Authentication includes a range of options for verification of card CVV values as part of the suite of authorization controls provided to client issuers.

- Risk Collaborative Network (RCN) service integrates multiple Visa products to collectively address dispute and fraud mitigation via enhanced data, merchant alerting, and process automation.

- Suspect Activity Report is a daily report customized to your institution’s parameters, quickly identifies excessive or abnormal levels of cardholder authorization activity.

- Visa Resolve Online (VROL) can be used to submit fraud advices and exception file listings to Visa.

- VIP Travel Monitor Service allows you to designate individual cardholders for special transaction processing and manual fraud case review.

- Visa Travel Notification Service (VTNS) incorporates cardholder self-reported travel plans into the VisaNet authorization message via an online form or your call center.

Need help? We’re happy to answer any questions you may have and help you improve your credit union’s card processing services.